About Christine

Christine is an Arizona native with over 25 years of experience originating residential mortgage loans. Christine has built a career helping a large and diverse range of clients. She effectively communicates with her clients and thinks outside the box, offering guidance and ideas. She looks at more than your short-term goals; she helps plan for the future. She takes the time to listen and provide the best loan terms for your circumstance. Christine resides in Scottsdale with her spouse Kirk and their fur baby, Valentino. In her free time, Christine enjoys being outdoors, traveling, and spending time with her family and friends.

Meet the rest of the team:

Natalie Rietz

Personal Mortgage Advisor | nmls# 2126383

602-680-8968

Natalie works closely with Christine on getting you preapproved and will explore your financing options for your new home or refinance. Natalie became a licensed loan officer after graduating from Arizona State University. She’s an Arizona native and is no stranger to the business as she grew up immersed in the home building industry. She always knew that helping people obtain their dream of homeownership was a passion of hers. During Natalie’s free time, she enjoys going out to dinner with family and friends, movie nights, and trying a new workout class.

Wendy Doschadis

Originator Assistant

Wendy has over 15 years of experience on the operations side. Wendy takes the loan from contract to close. She’s here to answer your upfront questions. This means she’ll walk you through the initial loan disclosures, work closely with our loan processor and will review your loan conditions, and all around make sure you’re taken care of customer service is her specialty! When Wendy isn’t working, she enjoys road trips with her kids and grandkids and loves to refinish furniture. She also has a love for animals. She owns a horse, birds, dogs, and a mini pig.

Andrea Lay

Loan Coordinator

Andrea is an Arizona Native with over 25 years of processing experience. Andrea is our loan processor, and she coordinates and communicates with our team, the underwriters, title, and closing department. Once we have a loan in process, she’ll verify employment, income, and assets and then put a pretty bow on it to submit to underwriting. Once we have loan approval, she’ll work closely with Wendy to ensure we collect what necessary documentation is needed. Andrea is married to Eric, and they have 2 boys which are now off to college. The Lay family has a love of baseball, and for their Weimaraner fur baby, Rawley. In Andrea’s spare time she enjoys hiking and spending time with her family and friends.

What Our Clients Say About TheMcConnell Team

We're incredibly thankful for over 150 clients who shared their homeownership experiences!

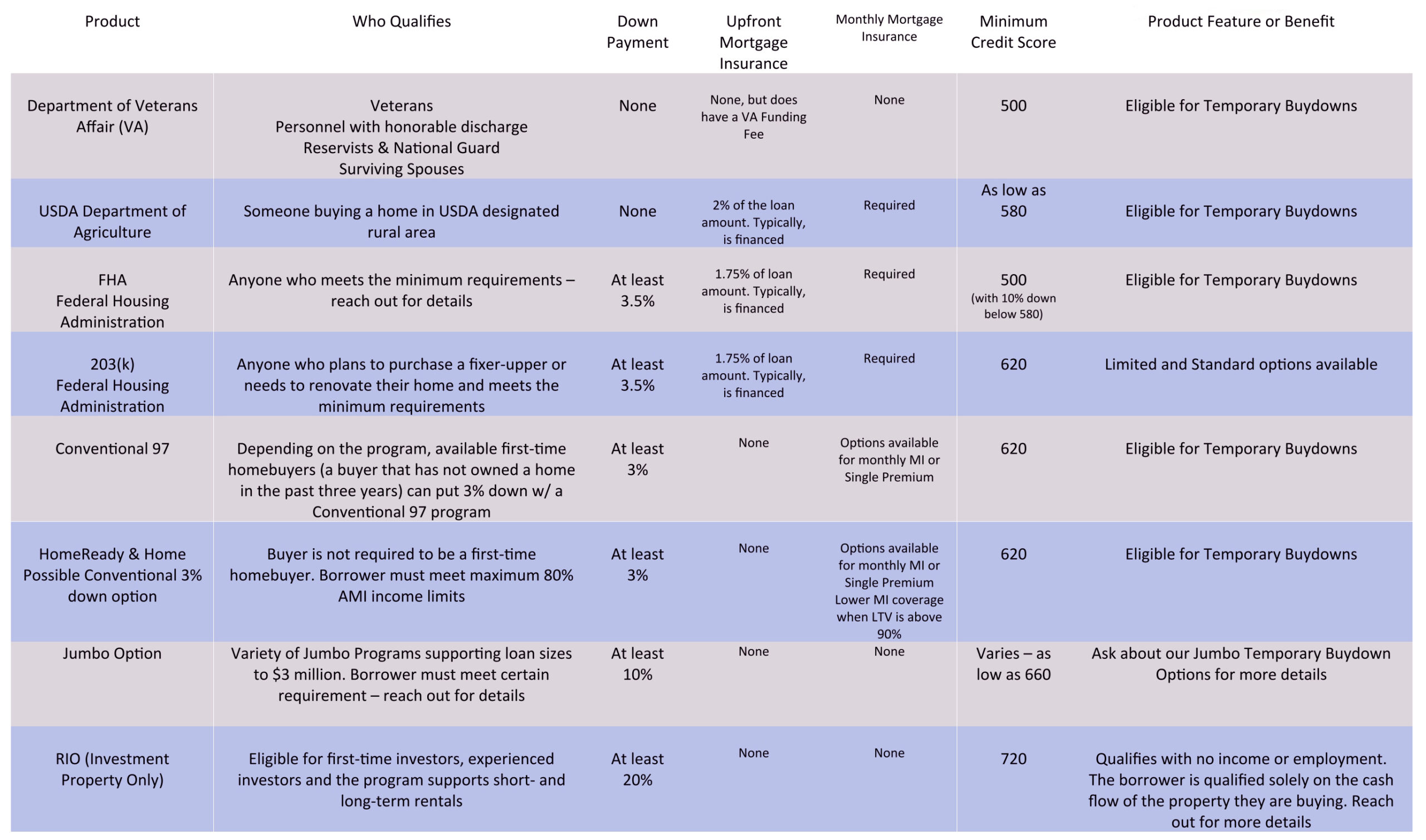

A few of our loan options:

Quick loan product overview:

Loan Types

It makes for the perfect type of loan to meet the needs of buyers from all walks of life.

FHA Loans Offer:

• Minimum down payment of only 3.5%

• Credit score as low as 500*

• Flexible debt-to-income ratios

• 100% of down payment and closing costs can be a gift

• Flexible reserve requirements

• Up to 6% seller contributions towards closing costs and pre-paid items

We Offer:

• Purchase loans

• Rate-term refinancing

• Cash-out refinancing

• Streamline refinance

• 203(h) - Mortgage Insurance for Disaster Victims

FHA

We offer:

• Low down payment options

• Eligible sources of funds include gift funds from eligible sources

• DPA assistance that may be available in your local markets

• Zero down payment options for VA and USDA buyers

• Reduced Mortgage Insurance requirements for certain programs

• FICO scores as low as 500 on certain products

1st Time Buyers

We offer:

• Purchase loans

• Rate-term refinancing

• Cash-out refinancing

Conventional

This jumbo loan product also supports a lower-than-industry average required down payment -perfect for those buyers who want to keep more cash in the bank – with all the benefits exceeding those of a conforming loan.

We Offer:

• Purchase, no cash-out refinance and cash-out refinance

• All occupancy types

• Loans to $2M

• Jumbo AUS

• Non-Warrantable Condos

• No Mortgage Insurance

• First-time homebuyers permitted

• Blended ratios

Jumbo

Find the perfect place to kick off your boots with 100% financing available or explore interest rate reductions or cash out refinance options.

We Offer:

• Purchase loan

• Cash-out refinancing

• Interest Rate Reduction Refinance Loan (IRRRL)

VA

Whether you are an experienced or a first-time homebuyer, you may be able to qualify for a USDA home loan with no money down! These government backed loans are perfect for families and individuals interested in purchasing homes in rural communities. Ask your personal mortgage advisor if this is the right loan for you!

We Offer:

• Purchase

• No cash-out refinance

• Streamline Refinance

• Simple Refinance

USDA

Ready to Talk Mortgages? Contact Christine Today.

480-628-6277

[email protected]

14350 N 87th St, Suite 105 Scottsdale, AZ 85260 | 877-203-7094 | Branch NMLS # 2119706

Terms of Use | Privacy Policy | State Disclosure Requirements | Texas Borrowers

This site is not authorized by the New York State Department of Financial Services. No mortgage solicitation activity or loan applications for properties located in the State of New York can be facilitated through this site.

![]()