Working with you.

Working for you.

Life is messy. Mortgages aren’t always easy. Our team at TotalChoice will walk you through the process step-by-step until your goals of home ownership are achieved.

Local presence

Convenience & peace of mind

Why TotalChoice?

We exceed client expectations with superior knowledge of the loan process and will assess the best option for you. Honesty and integrity are foundational pieces of our business. We treat our clients like family, providing insight and advice often absent in the business of buying and selling homes.

Attention to detail

Rather than wanting to just get your business, we want to learn about our clients. Everything from understanding your needs, to what lifestyle suits you, to how you like to communicate is in our interest. This helps us create an attentive home-buying experience for you and your family.

Seamless process

With a team of the most experienced lenders in the market, there is no area that we cannot help you with. We will guide you and explain every step of the process from starting your application to closing your home loan. By the end of the journey, you will be the expert!

Meet Our Trusted Team

We’re full of friendly team members with years of mortgage experience. We work with buyers and Realtors every step of the way.

Ohio

Schaun Blakeslee

Senior Construction Administrator

Pre-approved "ish" syndrome

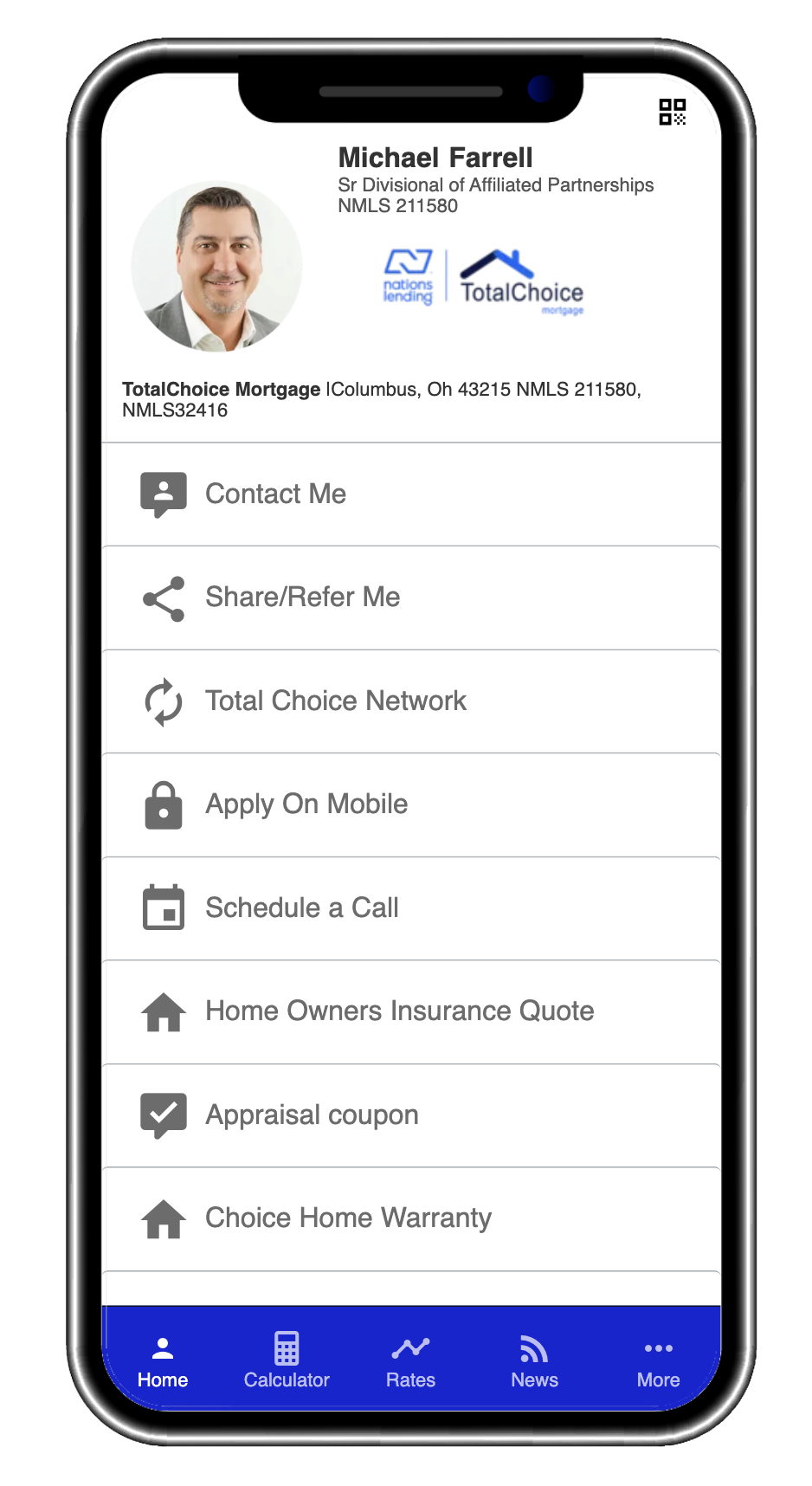

The built-in custom calculator lets you know exactly which homes you can qualify for. Powered by careful Loan Officer consideration & review of your income, you only need to input proposed purchase price, down payment, taxes and HOA's to determine what you qualify for.

Loan Milestones Checklist

Want to know where your loan is in processing, and what is next? Check your progress in seconds with our Loan Milestone Checklist!

Instant Pre-Approval Letter

If you qualify based on the accurate housing information on the app, you can have a pre-approval letter emailed to you instantly. A simple, easy, and quick pre-approval letter at your disposal in seconds.

Purchase Loan Management

Each time a new document is needed, you will be push notified and emailed with the latest status. Leading to more timely closings and a smooth, transparent process.

Loan Types

It makes for the perfect type of loan to meet the needs of buyers from all walks of life.

FHA Loans Offer:

• Minimum down payment of only 3.5%

• Credit score as low as 500*

• Flexible debt-to-income ratios

• 100% of down payment and closing costs can be a gift

• Flexible reserve requirements

• Up to 6% seller contributions towards closing costs and pre-paid items

We Offer:

• Purchase loans

• Rate-term refinancing

• Cash-out refinancing

• Streamline refinance

• 203(h) - Mortgage Insurance for Disaster Victims

FHA

We offer:

• Low down payment options

• Eligible sources of funds include gift funds from eligible sources

• DPA assistance that may be available in your local markets

• Zero down payment options for VA and USDA buyers

• Reduced Mortgage Insurance requirements for certain programs

• FICO scores as low as 500 on certain products

1st Time Buyers

We offer:

• Purchase loans

• Rate-term refinancing

• Cash-out refinancing

Conventional

This jumbo loan product also supports a lower-than-industry average required down payment -perfect for those buyers who want to keep more cash in the bank – with all the benefits exceeding those of a conforming loan.

We Offer:

• Purchase, no cash-out refinance and cash-out refinance

• All occupancy types

• Loans to $2M

• Jumbo AUS

• Non-Warrantable Condos

• No Mortgage Insurance

• First-time homebuyers permitted

• Blended ratios

Jumbo

Find the perfect place to kick off your boots with 100% financing available or explore interest rate reductions or cash out refinance options.

We Offer:

• Purchase loan

• Cash-out refinancing

• Interest Rate Reduction Refinance Loan (IRRRL)

VA

Whether you are an experienced or a first-time homebuyer, you may be able to qualify for a USDA home loan with no money down! These government backed loans are perfect for families and individuals interested in purchasing homes in rural communities. Ask your personal mortgage advisor if this is the right loan for you!

We Offer:

• Purchase

• No cash-out refinance

• Streamline Refinance

• Simple Refinance

USDA

BRANCH NMLS. 2535678 | 5251 NORWICH ST. HILLIARD, OH 43026 |

877-248-3639

Terms of Use | Privacy Policy | State Disclosure Requirements | Texas Borrowers

This site is not authorized by the New York State Department of Financial Services. No mortgage solicitation activity or loan applications for properties located in the State of New York can be facilitated through this site.

![]()